new short term capital gains tax proposal

Subscribe to receive email or SMStext notifications about the Capital Gains tax. Inslee proposed in his 2021-23 budget see Gov.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Massachusetts lawmakers push back on Charlie Bakers plan to slash short-term capital gains taxes double estate tax threshold Share this.

. 53 rows Under Bidens proposal for capital gains the US. But its also possible to be assessed short-term capital gains tax on the sale of other assets such as real estate vehicles or collectibles. This information relates to a capital gains tax as proposed in 2018.

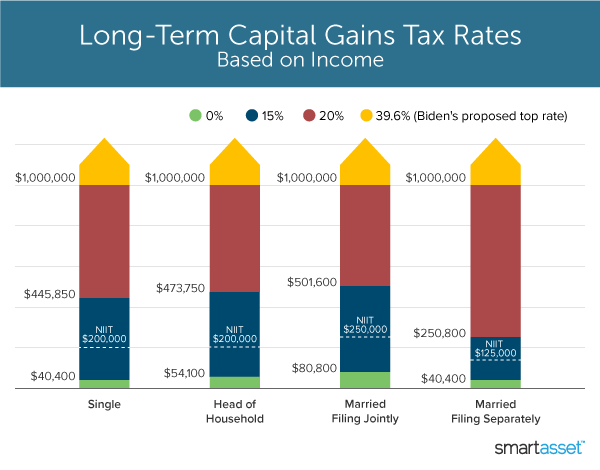

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. The institution says raising capital gains tax rates to the proposed level would be the highest since the 1920s potentially shaving off 01 percent from economic growth and reducing federal. Long-term capital gains such as from company stock sales currently have a top tax rate of 20 plus the 38.

The impacted assets include stocks bonds real estate and art. In addition the Net Investment Income Tax would be assessed which tacks on an extra 38 in tax and the average top state capital gains tax rates would. Including a 38 Medicare surtax on high earners the top capital gains rate would be 288 taking effect in tax years ending after Sept.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. President Joe Biden is expected to propose raising the top federal capital gains tax to 396 from the current 20 for millionaires. Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is.

The top short-term capital gains tax rate is 37. The proposal would tax long-term capital gains as ordinary income for taxpayers with taxable income above 1 million and raise the top marginal income tax rate to 396 percent. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37.

The IRS taxes short-term capital gains like ordinary income. Prepared by the Department of Revenue Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by. Sole proprietor income retirement accounts homes farms and forestry are exempt.

Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396. The short-term capital gains tax is typically applied to the sale of securities including stocks and mutual funds. To see what Gov.

Economy would be smaller American incomes. History Of The Top Long-Term Capital Gains Tax Rate. For taxpayers with income above 1 million the long-term capital gains rate would increase to.

Joe Biden proposes that for individuals with taxable income greater than 1M in a year their capital gains would be taxed as ordinary income under standard income bracketsup to 37 under current tax code and up to 395 as proposed by. Inslees 21-23 capital gains tax proposal QA. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets.

The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. The Build Back Better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross income MAGI above 25 million including on capital gains income. 7 rows Federal short-term capital gainsincome tax rate Single Married filing jointly Married.

House democrats on monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed. The new tax would affect an estimated 58000 taxpayers in the first year. Capital Gains Tax Rate.

Proposed capital gains tax under the proposed build back better act the top marginal tax rates will jump from 20 to. Short-term capital gains on listed equities held for under a year is taxed at 15. The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to.

More from Your Money Your Future. New short term capital gains tax proposal. The Presidents proposal would be to tax long-term capital gains on ordinary income for taxpayers with taxable income above 1000000 and to raise the top marginal income tax rate to 396.

Best short-term investments. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. The top long-term capital gains rate has been 20 since 2013 according to.

The resulting 318 percent top marginal tax rate would be the highest federal tax rate on capital gains since the 1970s and above the generally estimated revenue-maximizing rate of. Short-term capital gains tax is a tax on gains resulting from the sale of assets youve held for one year or less. As part of his presidential platform president Biden has proposed changing the special treatment on income from the sale of capital assets.

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes

Short Term Capital Gains Stcg Meaning Income Tax Rate Calculation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

How High Are Capital Gains Taxes In Your State Tax Foundation

Selling Stock How Capital Gains Are Taxed The Motley Fool

Pin By Karthikeya Co On Tax Consultant Mutuals Funds Capital Gain Fund

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Full Report Tax Policy Center

Capital Gains Full Report Tax Policy Center

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Budgeting Fund

The Capital Gains Tax And Inflation Econofact

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)